UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| þ | Filed by the Registrant | o | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

LINCOLN ELECTRIC HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

| 03 |

| - |

|

DEAR SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of Shareholders of Lincoln Electric Holdings, Inc., which will be held at 11:00am ET on Wednesday, April 24, 2019 at Lincoln Electric’s Welding Technology & Training Center, 22800 St. Clair Avenue, Cleveland, Ohio. A map of the location is printed on the inside back cover of this proxy statement.ANNUAL MEETING

OF SHAREHOLDERS

| ITEMS TO BE VOTED ON |

RECOMMENDATION | |

|

Director nominees | PAGE 19 |

|

| PAGE 87 |

PROPOSAL 3 To approve, on an advisory basis, the compensation of our named executive officers (NEOs) for 2020 |

| PAGE 89 |

By Order of the Board of Directors,

Christopher L. Mapes Chairman, President and Chief Executive Officer |

|

Jennifer I. Ansberry Executive Vice President, General Counsel and Secretary | ||

WE WILL BEGIN MAILING THIS PROXY STATEMENT ON OR ABOUT MARCH 22, 2019.19, 2021.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 24, 2019:22, 2021:

This proxy statementProxy Statement and the related form of proxy, along with our 20182020 Annual Report andon Form 10-K, are available free of charge at www.lincolnelectric.com/proxymaterials.

DATE & TIME THURSDAY, APRIL 22, 2021 11:00 AM ET PLACE Online at ACCESS Online at PARTICIPATION Submit pre-meeting questions online by visiting RECORD DATE Shareholders of record on the close of | |||

HOW TO CAST YOUR VOTE Your vote is important! Please vote your shares promptly in one of the following ways: | |||

| April 21, 2021 | ||

| BY PHONE | ||

| BY MAIL | ||

| DURING MEETING Vote online on April 22, 2021 during the Annual Meeting at | ||

| www.virtualshareholdermeeting.com/LECO2021 | |||

| 05 |

| - |

|

BUSINESS OVERVIEW

| 06 |

| - |

|

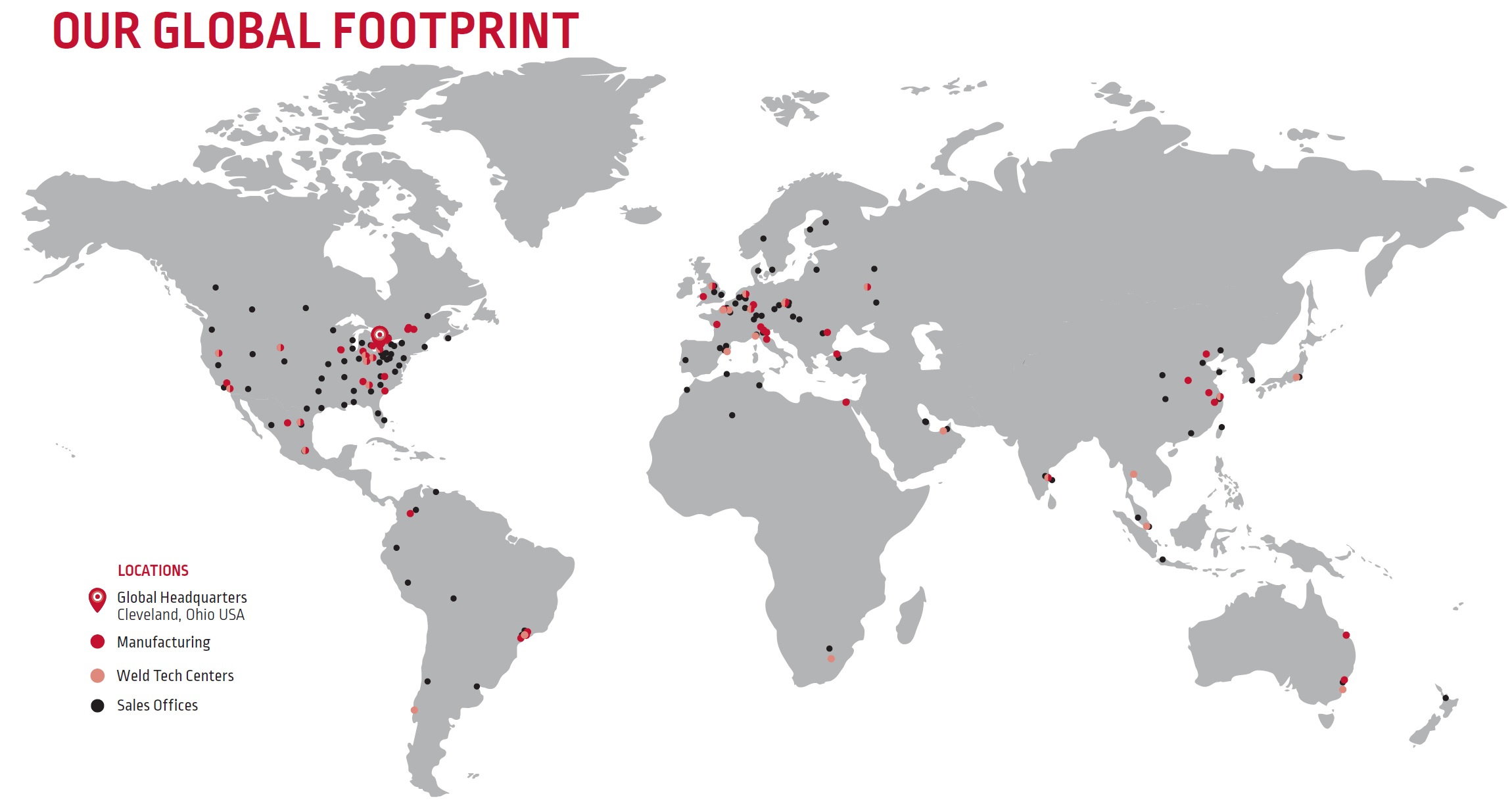

OUR GLOBAL FOOTPRINT

OUR GUIDING PRINCIPLE: THE GOLDEN RULE

TREAT OTHERS AS YOU WOULD LIKE TO BE TREATED

For nearlyover 125 years, we have achieved success through a balanced approachinnovation and business practices that seek to align our focus instakeholders. Our long-term strategic initiatives and investments drive alignment by providing:

| · | Customers with |

| · |

|

· ShareholdersSuppliers with above market returns.a shared commitment to responsible operations that are safe, compliant and efficient;· Communities with a responsible and engaged partner who is focused on helping communities thrive; and · Shareholders with above-market returns.

In 2010, we mobilized

The 2025 Strategy’s key financial and sustainability targets align with substantially all of the organization around a ten year “2020 VisionCompany’s key short-term and Strategy” that focuses on expanding our position as a valued, technical solutions-providerlong-term compensation metrics and are incorporated in our industry by accelerating innovation, operational excellence,the Chief Executive Officer’s compensation goals and achieving best-in-class financial results through an economic cycle. The strategy is founded on our values and organizes commercial and operational initiatives around six core capabilities and competitive advantages to drive growth and improved margin and return performance: welding process expertise, commercial excellence, product development, global network and reach, operational excellence and financial discipline.cascade throughout the organization.

|

In executing our “2020 Vision and Strategy,” we have pursued an aggressive acquisition strategy, accelerated our investments in R&D to enhance the value proposition and positioning of our solutions, and have emphasized engineered solutions for mission-critical applications. Additionally, we have focused on expanding our brand’s geographic and channel reach into attractive areas such as automation. Our efforts have been successful. Contributions from acquisitions, a strong vitality index of new products, and expanded market presence have helped improve margin performance and returns. Our focus on operational excellence, safety and sustainability initiatives have helped structurally improve our operations and have contributed to improved margins, cash flow generation and returns. We are well positioned for improved long-term operating performance of the business through the economic cycle.

Our financial performance against our “2020 Vision & Strategy” goals reflects steady progress across most metrics:

|

| ||||

|

|

| |||

Average Annual Sales Growth (organic & inorganic) | Mid-to-high single-digit percent 2020-2025 | X (Individual Performance Goals or Business Unit Performance Goals May include Sales Growth) | X1 | ||

Average Adjusted Operating Income Margin | Average | X1 (Representative of EBITB) | |||

Average Operating Working Capital Ratio | 15% in 2025 | X1 | |||

Return on Invested |

|

| |||

|

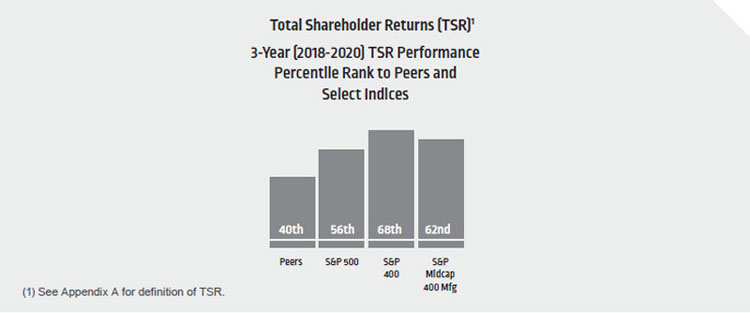

Top quartile performance vs. |

|

| (1) | Performance measures used in the design of the executive compensation program are defined in Appendix A |

| 07 |

| - |

|

BUSINESS OVERVIEW

| 08 |

| - |

|

Employee engagement and development is a key focus of our 2025 Strategy as a highly engaged workforce is safer, innovative, productive, and generates long-term value for the organization. Our 2025 Strategy human capital investments enhance employee development and training through a range of online self-guided and instructor-led educational and experiential programs, skills training and career resources. This programming continues to expand to reach employees globally with learning and development opportunities targeted to all levels of the organization to promote personal development, career pathways and employee retention at Lincoln Electric.

|

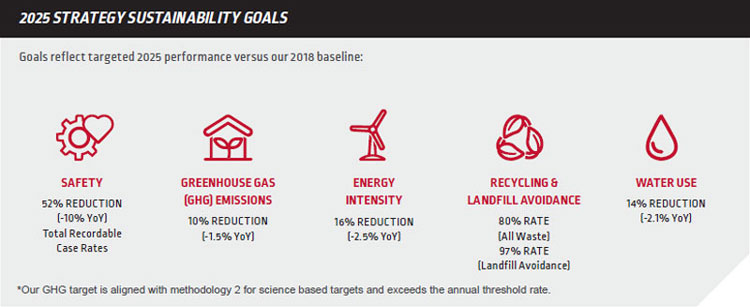

In addition to our educational and career development programs, our annual talent and succession planning process reviews 100% of our global professional staff to ensure an appropriate talent pipeline for critical roles in general management, engineering and operations. This evaluation includes our CEO and all segment and functional leaders who use this process to identify and support high potential and diverse talent in a succession planning for the next generation of Lincoln Electric’s leaders. The 2025 Strategy also incorporates the following long-term 2025 safety and environmental goals:

|

In addition, we focus on product stewardship in the design and manufacture of our products to improve safety, advance energy efficiency and reduce waste in our customers’ welding operations. We measure energy efficiency improvements achieved in our welding equipment as we transition our equipment portfolio from a transformer-based platform to a more efficient digital, inverter-based system. Product stewardship initiatives also include efforts to reduce packaging waste, digitization of product reference material, and the increased use of intermodal transportation to reduce the carbon footprint of our products in the supply chain.

ANNUAL MEETING INFORMATION

ANNUAL MEETING OF SHAREHOLDERS

|

|

|

HOW TO CAST YOUR VOTE //

Your vote is important! Please vote your shares promptly in one of the following ways:

|  |  |  |

|

|

|

|

MEETING AGENDA VOTING MATTERS //

|

|  | ||

|

|  | ||

|

|  |

PROXY SUMMARY

This section provides an overview of important items related to this proxy statementProxy Statement and the 2021 Annual Meeting. We encourage you to read the entire proxy statementProxy Statement for more information before voting.

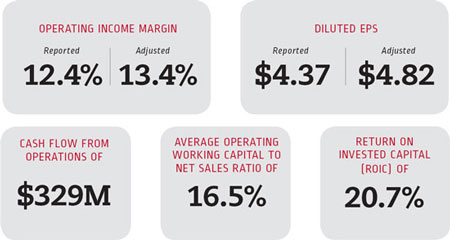

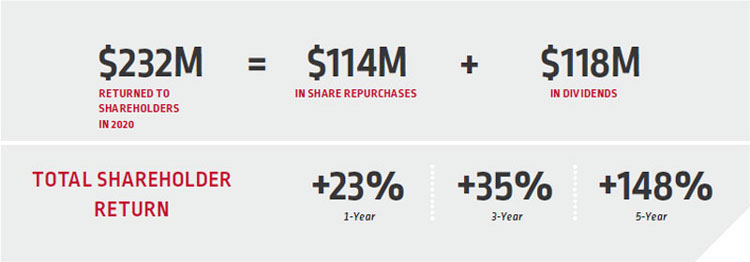

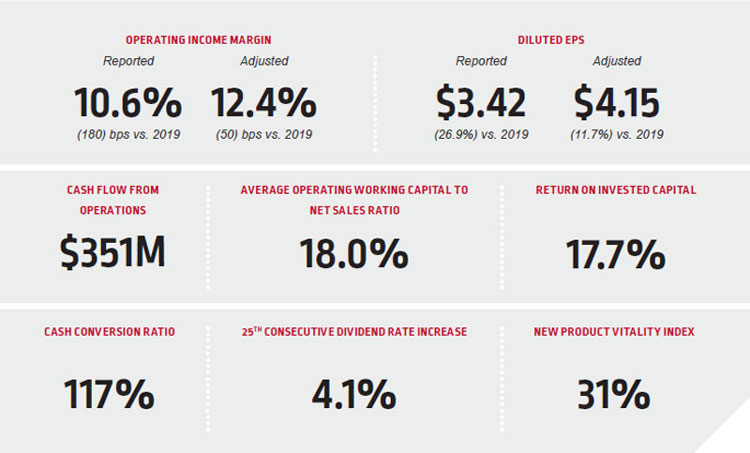

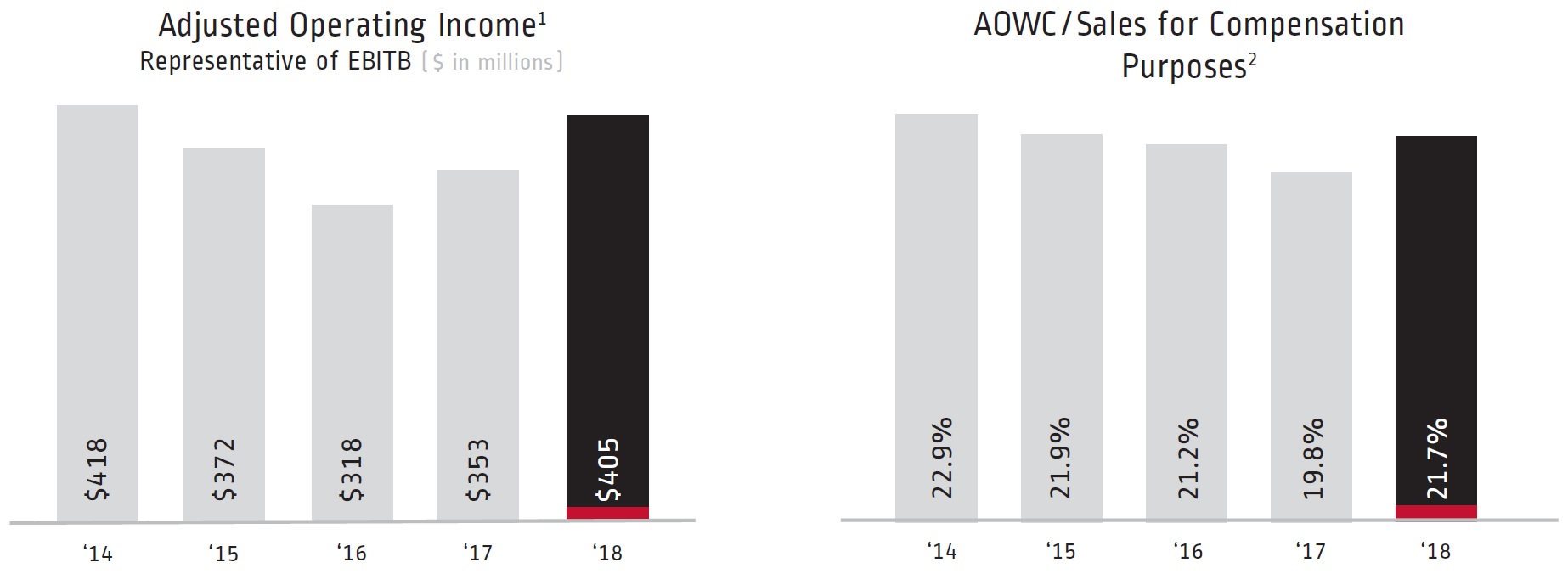

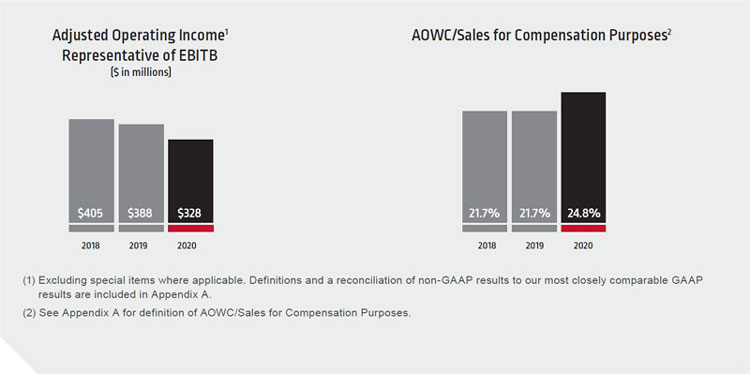

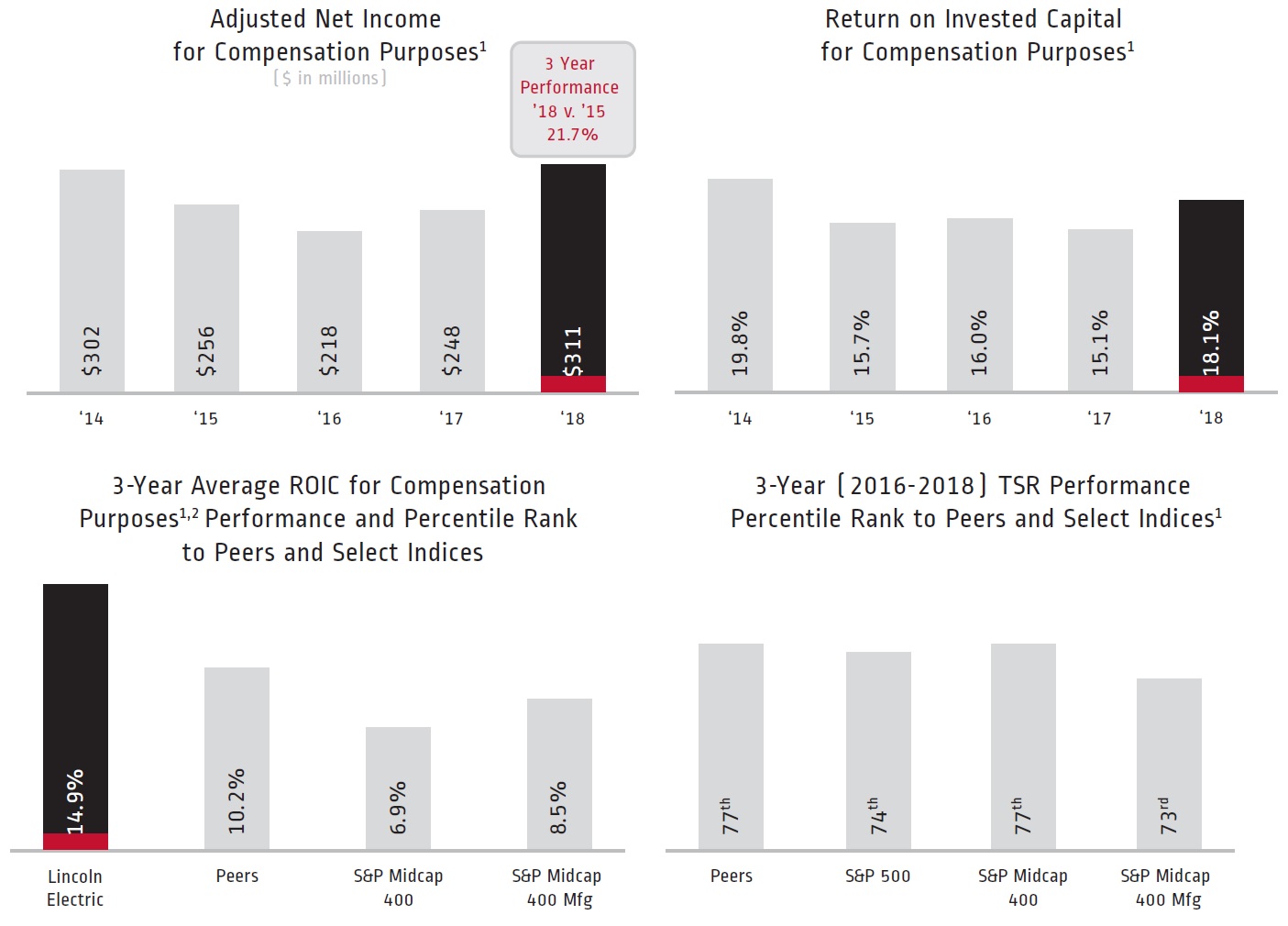

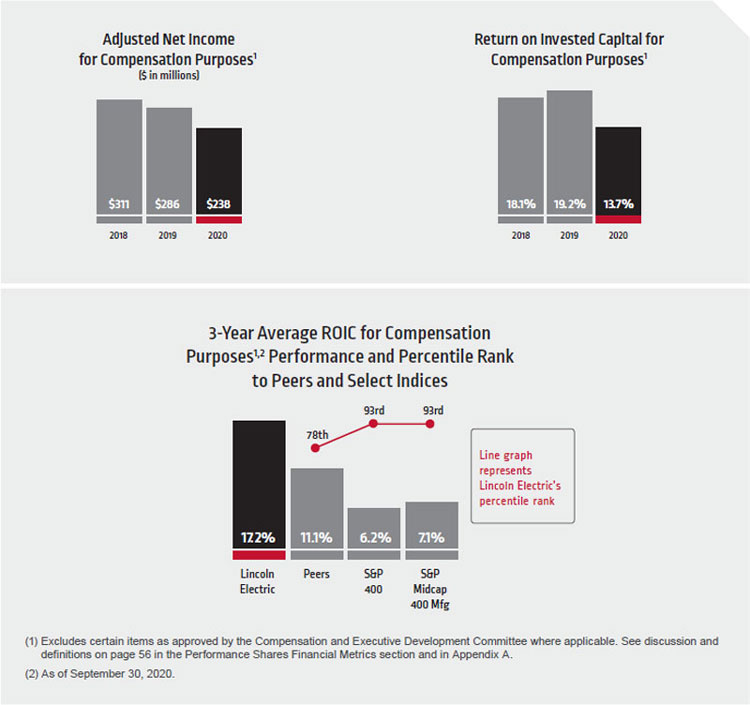

20182020 PERFORMANCE HIGHLIGHTS //

We achieved solid performanceoperated as an “essential business” in 2018 capitalizing on broad industrial growth in many areas2020 and continued to manufacture and service customers globally, while maintaining the health and safety of our business. Sales increased 15%employees and communities through best practice Center for Disease Control and World Health Organization health and safety measures and remote work arrangements. Despite the unprecedented operational and safety challenges posed by the COVID-19 pandemic, our employees and operating model were resilient. Our strong balance sheet and liquidity allowed us to a record $3.0 billionminimize the impact on 6.7% organic saleswages, benefits and bonus programs, with the objective of maintaining our workforce through the pandemic, while investing in long-term growth and 9% from acquisitions, substantially from the Air Liquide Welding (ALW) acquisition. We generated solid profit growth (excluding special items) from attractive volume growth in Americas Welding, favorable mix, effective price management, disciplined expense controls and operational excellence. Successful execution of a number ofadvancing our strategic commercial and operational initiativesinitiatives. In addition, early implementation of cost reduction actions helped mitigate the impact of lower demand. To ensure product availability, we maintained higher levels of working capital to minimize the risk of supply chain disruptions during the pandemic. These actions resulted in strongsolid returns, cash flows, solid return performance,flow generation, and 117% cash conversion in 2020.

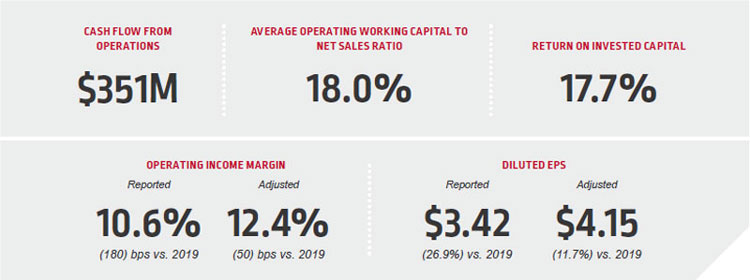

Sales decreased 11.6% to approximately $2.7 billion primarily due to 12.2% lower organic sales, which were partially offset by a 1.3% benefit to sales from an acquisition. Operating income margin declined 180 basis points to 10.6% versus the prior year, primarily due to lower sales and rationalization and asset impairment charges. Adjusted operating income margin held relatively steady, declining 50 basis points to 12.4% as well as good working capital efficiencyprice management and approximately $88 million in our business. We also continued to meet or exceed threecost reduction benefits substantially mitigated the unfavorable impact of our four 2020 sustainability goals despite the substantial addition of the ALW platform. In 2018, we continued to meet or exceed 2020 targets in greenhouse gas emissions, energy intensity, and our re-use and recycling rates. These results demonstrate the continued structural improvements achieved in the business through our “2020 Vision and Strategy” and how the organization continues to advance towards best-in-class performance.lower volumes.

See Appendix A for definitions and/or reconciliation of these metrics to results reported in accordance with GAAP. Performance measures used in the design of the executive compensation program are presented within the Compensation Discussion and Analysis section.

| 09 |

| - |

|

| 10 |

| - |

|

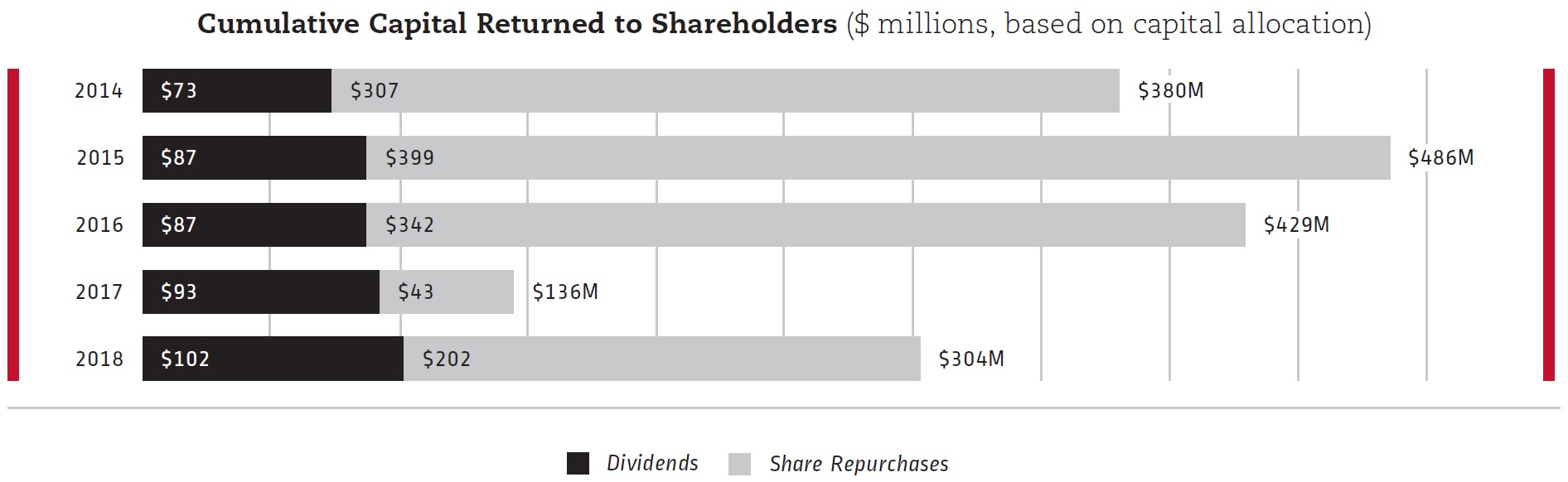

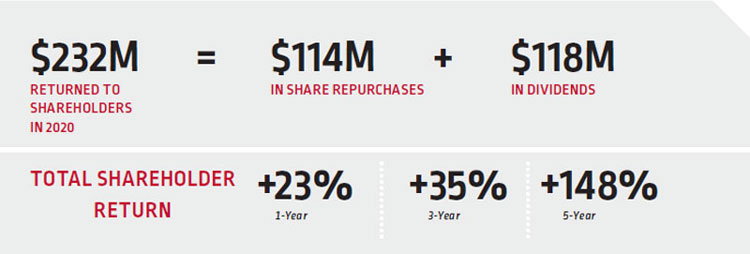

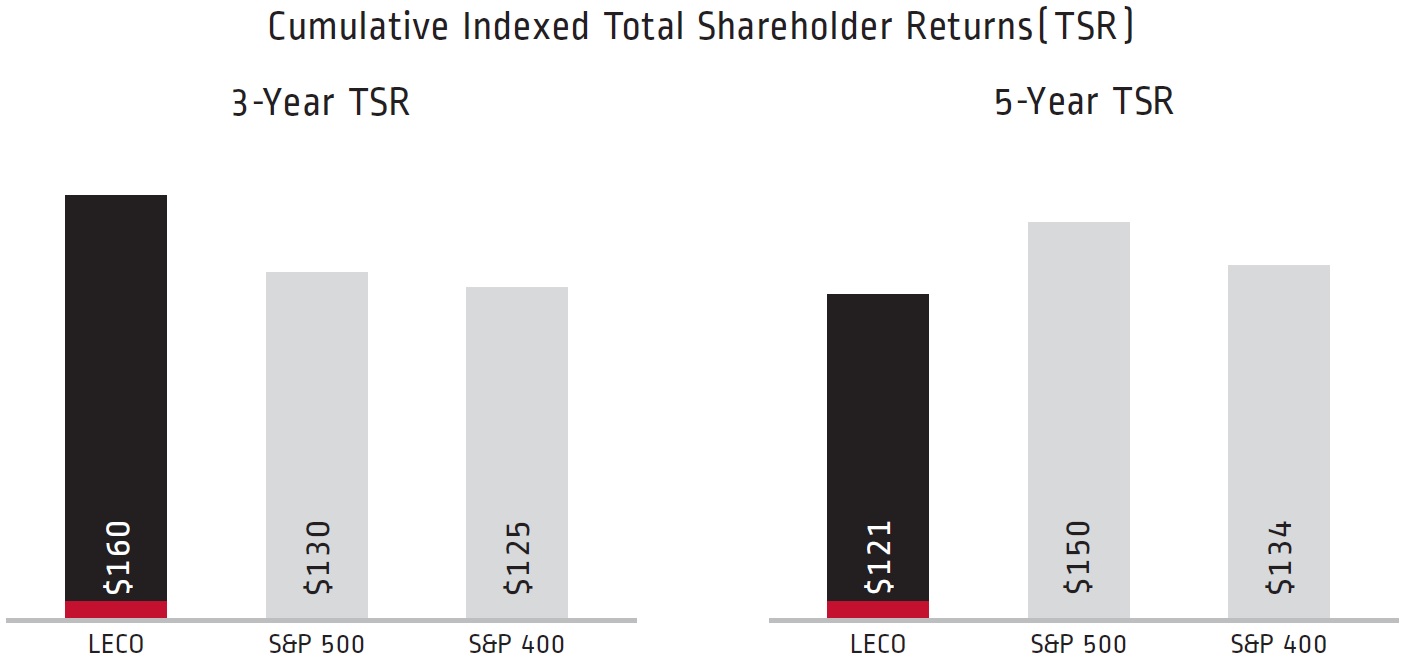

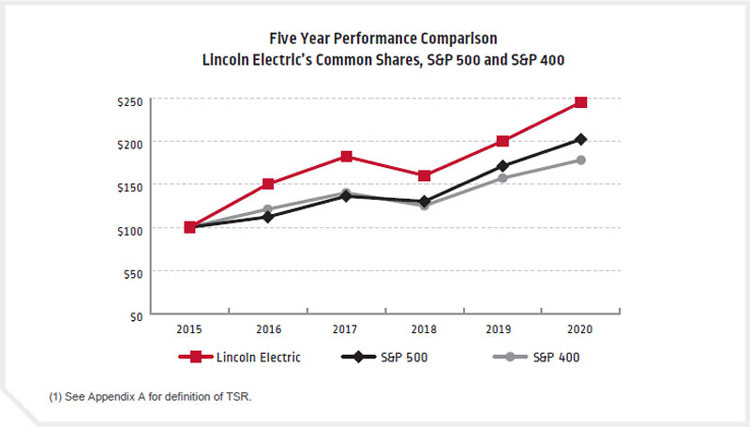

In addition,Despite challenging operating conditions, we continued to focus on generating long-term value for our shareholders.pursue a balanced capital allocation strategy to generate strong shareholder returns. In 2018,2020, we deployed approximately $477returned $232 million towards a combination of growth investments (capital expenditures and acquisitions) and the return of cash to shareholders through our dividend program and share repurchases. In addition, the last five years, we have repurchased an aggregate amount of $1.3 billion in shares and have increasedBoard approved the Company’s 25th consecutive dividend increase, raising the dividend payout rate by 70%4.1%. Our Board increased

Safety and operational excellence are a priority at Lincoln Electric and we proudly achieved record safety, carbon reduction and recycling performance in 2020. This achievement, combined with improved environmental performance across most metrics, demonstrates the dividend payout rate by 21% for 2019, marking 23 years of consecutive dividend increases.continued structural improvements achieved in the business through our 2025 Strategy and our commitment to best-in-class performance.

| 2020 GOAL (VS. 2011 BASELINE) | 2020 PERFORMANCE (VS. 2011 BASELINE) | |

| Safety (DART) | 75% Reduction | Record 85% Reduction |

| Greenhouse Gas Emissions (Absolute) | 15% Reduction | Record 36% Reduction |

| Energy Intensity | 30% Reduction | 25% Reduction1 |

| Recycling (All Waste) | 70% Rate | Record 75.1% Rate |

| (1) | Our 2020 energy intensity performance was unfavorably impacted by production hours due to the COVID-19 pandemic. |

Increased outreach was critical in 2020 to safeguard local communities facing the health and economic impact of the COVID-19 pandemic. Internally, the Company minimized the impact on wages, benefits and bonus programs, with the objective of maintaining its workforce through the pandemic. In addition, the Company’s employee assistance program supported eligible employees who required extra financial support. Community engagement was extended beyond our standard program of grants, scholarships, employee matching, in-kind donations and volunteerism. Emergency grants to foodbank programs, participation in a COVID-19 rapid response fund in Cleveland (our global headquarters), and personal protection equipment donations to first responders were key 2020 initiatives. In addition, we maintained our community educational/career programming among secondary and high school students to address skills gaps in industry and maintain awareness of attractive career pathways in manufacturing. This programming, along with expanded training and development opportunities for our employees in 2020, were key efforts to ensure long-term success for our key stakeholders.

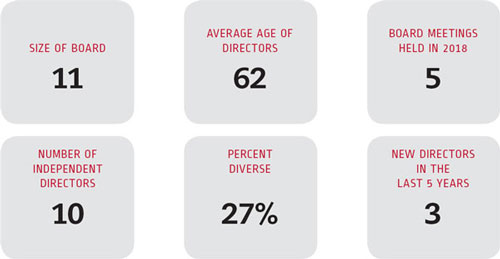

CORPORATE GOVERNANCE HIGHLIGHTS //

Lincoln Electric has a solid track record of integrity and corporate governance practices that promote thoughtful management by its officers and Board of Directors, facilitating profitable growth while strategically balancing risk to maximize shareholder value. Below is a summary of certain Board and governance information with respect to 2018:2020:

| BOARD COMPOSITION AND PRACTICES | ||||

| Size of Board | ||||

| Number of independent Directors | ||||

| Average age of Directors | ||||

| Percent diverse (among independent directors) | ||||

| Female Directors | ||||

| Non-white Directors | ||||

| Board meetings held in | ||||

| New Directors in the last 5 years | 3 | |||

| Average | ||||

| Annual election of Directors | ||||

| Majority voting policy for Directors | ||||

| Lead Independent Director | ✔ | |||

* Following the retirements of two directors in April 2018 and the election of one director in July 2018, there were 11 Directors (10 were independent) during the 2018 calendar year.

| * | Following the election of one director in October 2020, there were 12 Directors (11 were independent) during the 2020 calendar year. |

| Number of fully independent Board committees | 4 |

| Independent Directors meet without management | ✔ |

| Director attendance at Board and committee meetings | >75% |

| Mandatory retirement age (75) | ✔ |

| Stock ownership guidelines for Directors | ✔ |

| Annual Board and committee self-assessments | ✔ |

| Code of Conduct and Ethics for Directors, officers & employees | ✔ |

| No overboarded Directors (per ISS or Glass Lewis) | ✔ |

| Succession planning and implementation process | ✔ |

| Strategy, ESG and risk management oversight | ✔ |

| Corporate culture, diversity and inclusion oversight | ✔ |

| SHAREHOLDER PROTECTIONS | |

| One share, One vote standard | ✔ |

| Dual-class common stock or Poison pill | ✘ |

Cumulative voting | ✘ |

| Vote standard for Code of Regulations amendment | 67% |

| Shareholder right to call a special meeting | ✔* |

| Annual election of Directors | ✔ |

| Majority voting policy for Directors | ✔ |

| Lead Independent Director | ✔ |

| Executive sessions without management present | ✔ |

| * | Special meetings can be called by shareholders holding not less than 25% of the voting power |

| COMPENSATION PRACTICES | |

| Pay for Performance | ✔ |

| Annual Say-on-Pay Advisory Vote | ✔ |

| Compensation aligned with strategic goals and individual performance | ✔ |

| Incentive plans do not encourage excessive risk taking | ✔ |

| No excessive perquisites | ✔ |

| Robust stock ownership guidelines for NEOs | ✔ |

| Clawback policy | ✔ |

| Double-trigger change-in-control | ✔ |

| Anti-hedging/pledging policy | ✔ |

| CEO Pay Ratio | 145:1 |

| ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG) POLICIES AND ENVIRONMENTAL GOALS | |

| Compensation and Executive Development Committee oversight of corporate culture, diversity and inclusion | ✔ |

| Audit Committee oversight of ESG matters, including environmental, health & safety | ✔ |

| Audit Committee oversight of information security matters | ✔ |

| ESG performance incorporated into CEO’s annual performance goals | ✔ |

| Global Code of Conduct and Ethics | ✔ |

| Human Rights Policy | ✔ |

| No-Harassment Policy | ✔ |

| Anti-Corruption Policy | ✔ |

| Supplier Code of Conduct | ✔ |

| Environmental, Health, Safety & Quality Policy | ✔ |

| Environment management system | ✔ |

| Long-term safety and environmental goals | ✔ |

| 11 |

| - |

|

PROXY SUMMARY

| 12 |

| - |

|

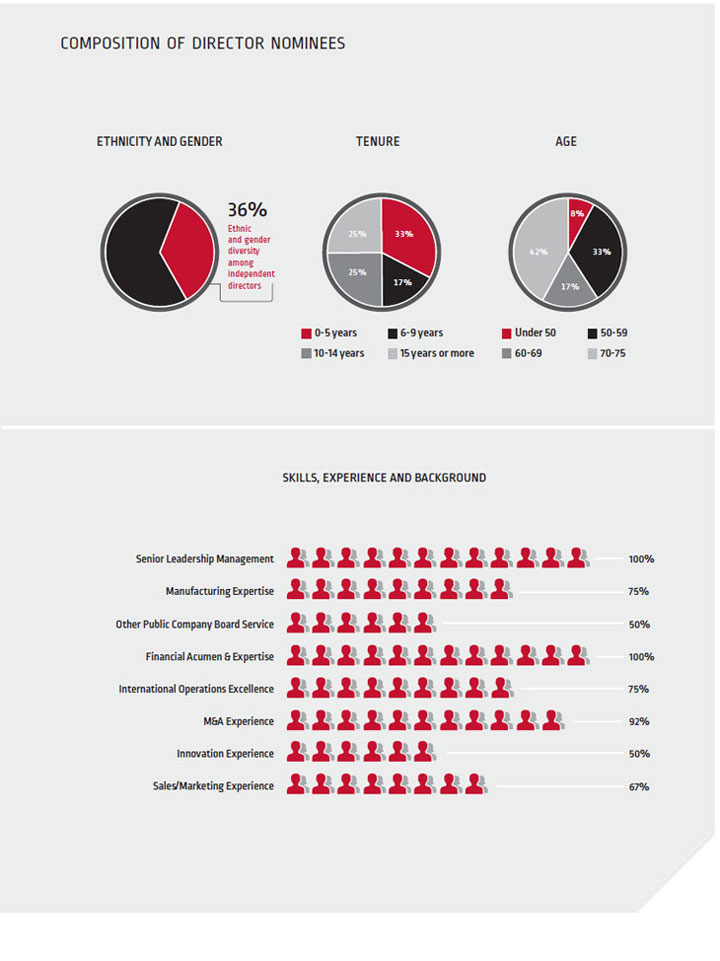

DIRECTOR NOMINEES AND BOARD SUMMARY //

PROPOSAL 1 Election of 12 Directors to serve until 2022 Annual Meeting or until their successors are duly elected and qualified |  | The Board recommends a vote FOR all Director Nominees. Our Nominating and Corporate Governance Committee and our Board of Directors have determined that each of the Director nominees possesses the right skills, qualifications and experience to effectively oversee Lincoln Electric’s long-term business strategy. |

| ➜ | See “Proposal 1 – Election of Directors” beginning on page 19 of this Proxy Statement. |

You are being asked to vote on the election of eleventwelve Director nominees. SummarySelected biographical information of each Director nominee, as well as committee membership and committee chair information is listed below. Additional information can be found in the Director biographies under Proposal 1.

Director NomineesDIRECTOR NOMINEES

Name |

Age |

Director Since |

Independent |

Audit | Compensation & Executive Development | Nominating & Corporate Governance |

Finance | Other Public Company Boards |

Age | Director Since |

Independent | Audit | Compensation & | Nominating & | Finance | Other Public Company Boards |

| Curtis E. Espeland(Lead Director) Executive Vice President and CFO, Eastman Chemical Company |

54 |

2012 |

ü |

● |

● |

— | ||||||||||

Patrick P. Goris Senior Vice President and CFO, Rockwell Automation, Inc. |

47 |

2018 |

ü |

● |

● |

— | ||||||||||

Curtis E. Espeland Retired Executive Vice President and CFO, | 56 | 2012 | ✔ | · | · | — | ||||||||||

Patrick P. Goris Senior Vice President and CFO, | 49 | 2018 | ✔ | · | · | — | ||||||||||

Stephen G. Hanks Retired President and CEO, Washington Group International |

68 |

2006 |

ü |

■ |

● |

— | 70 | 2006 | ✔ | ♦ | · | — | ||||

| Michael F. Hilton President and CEO, Nordson Corporation |

64 |

2015 |

ü |

● |

● |

2 | ||||||||||

Michael F. Hilton Retired President and CEO, | 66 | 2015 | ✔ | · | 2 | |||||||||||

G. Russell Lincoln President, N.A.S.T. Inc. |

72 |

1989 |

ü |

● |

● |

— | 74 | 1989 | ✔ | · | · | — | ||||

Kathryn Jo Lincoln Chair and CIO, Lincoln Institute of Land Policy |

64 |

1995 |

ü |

● |

■ |

— | 66 | 1995 | ✔ | · | ♦ | — | ||||

| William E. MacDonald, III Retired Vice Chairman, National City Corporation |

72 |

2007 |

ü |

■ |

● |

— | 74 | 2007 | ✔ | ♦ | · | — | ||||

Christopher L. Mapes(Chairman) President and CEO, Lincoln Electric Holdings, Inc. |

57 |

2010 |

1 | 59 | 2010 | 1 | ||||||||||

Phillip J. Mason Retired President, EMEA Sector of Ecolab, Inc. |

68 |

2013 |

ü |

● |

■ |

1 | 70 | 2013 | ✔ | · | ♦ | — | ||||

Ben P. Patel Senior Vice President and Chief Tenneco, Inc. |

51 |

2018 |

ü |

● |

● |

— | ||||||||||

Ben P. Patel Senior Vice President and Chief | 53 | 2018 | ✔ | · | · | — | ||||||||||

| Hellene S. Runtagh Retired President and CEO, Berwind Group |

70 |

2001 |

ü |

● |

— | 72 | 2001 | ✔ | · | — | ||||||

Kellye L. Walker Executive Vice President and Chief Legal | 54 | 2020 | ✔ | · | — | |||||||||||

■♦ Chair●· Member

| 13 |

| - |

|

| 14 |

| - |

|

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM SUMMARY

PROPOSAL 2 Ratification of independent registered public accounting firm |  | The Board recommends a vote FOR this proposal. Our Board of Directors recommends that shareholders vote “FOR” the ratification of the appointment Ernst & Young LLP as Lincoln Electric’s independent registered public accounting firm for the year ending December 31, 2021. |

| ➜ | See “Proposal 2 – Ratification of Independent Registered Public Accounting Firm” beginning on page 87 of this Proxy Statement. |

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS //

PROPOSAL 3 Approval, on an advisory basis, of NEO Compensation |  | The Board recommends a vote FOR this proposal. Our Board of Directors recommends that shareholders vote “FOR” the approval, on an advisory basis, of compensation of our NEOs for 2020. |

| ➜ | See “Proposal 3 – Approval, on an Advisory Basis, of Named Executive Officer Compensation” beginning on page 89 of this Proxy Statement and “Compensation Discussion and Analysis” beginning on page 38 of this Proxy Statement. |

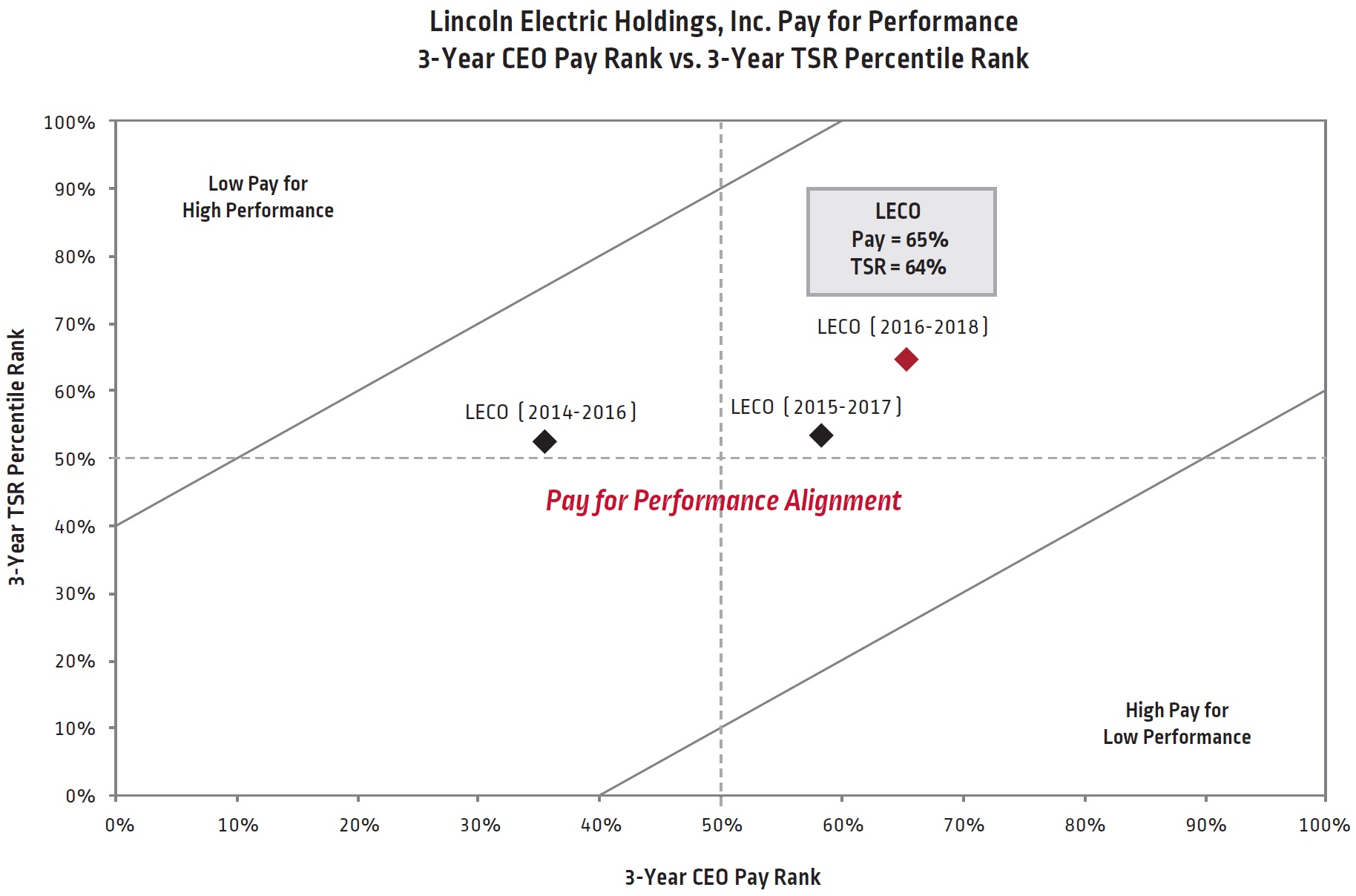

We have a long history of driving an incentive management culture, emphasizingpay for performanceto align compensation with the achievement of enterprise, segment and individual goals.

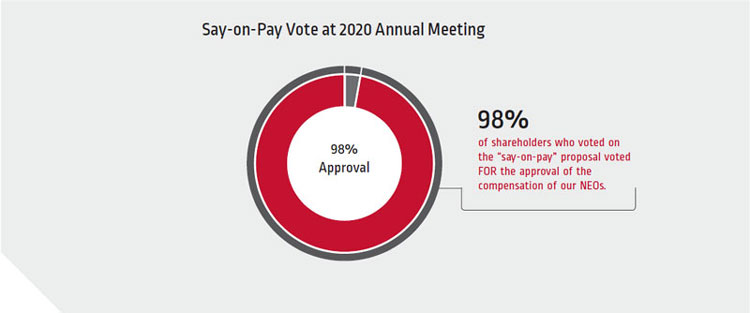

We believe our compensation program and practices provide an appropriatebalancebetween profitability, cash flow and returns, on the one hand, and suitable levels of risk-taking, on the other. This balance, in turn, aligns compensation strategies withshareholder interests,, as reflected by the consistentconsistently high level of shareholders voting for the compensation of our named executive officers (NEOs).

NEOs.

2020 NAMED EXECUTIVE OFFICERS

The Compensation Discussion and Analysis (CD&A) provides information regarding our executive compensation program for the

following NEOs in 2020:

| Christopher L. Mapes Chairman, President and Chief Executive Officer |  | Steven B. Hedlund Executive Vice President, President, | |

| Gabriel Bruno Executive Vice President, Chief Financial Officer and Treasurer |  | Jennifer I. Ansberry Executive Vice President, General Counsel and Secretary | |

| Michele R. Kuhrt Executive Vice President, Chief |

Vincent K. Petrella (retired during 2020) Former Executive Vice President, Chief | George D. Blankenship (retired during 2020) Former Executive Vice President, President, |

ACTIONS TO FURTHER ALIGN EXECUTIVE COMPENSATION WITH SHAREHOLDER INTERESTS

The Compensation and Executive Development Committee of the Board reviews the framework of our executive compensation program and seeks to ensurealign executive pay aligns with our pay for performance philosophy. OurEach year, our Compensation and Executive Development Committee has made a number of changes over the last few yearsmonitors our executive compensation program and how it relates to ensureour corporate performance alignment withand shareholder interests, which has been reflected in the strong results oninterests. The historically high approval of our “say-on-pay” proposals on the compensation of our NEOs. NEOs, including at the 2020 Annual Meeting, demonstrate the alignment of our executive compensation program with corporate performance and shareholder interests.

In 2018,2020, our Compensation and Executive Development Committee reviewed the overall design of our executive compensation program, particularly in light of the transition to the 2025 Strategy. The overall design of our executive compensation program was held consistent with policies developed in prior years. Throughout the year, our Compensation and Executive Development Committee monitored the impact of the COVID-19 pandemic on our executive compensation program, including pay for performance, alignment with stockholder’s interests, and motivation and retention of key talent.

2020 EXECUTIVE COMPENSATION PRACTICES | |||

| What We Do | What We Don’t Do | ||

| We have long-term compensation programs focused on profitability, net income growth, ROIC and total shareholder returns | ✔ | We do not allow hedging or pledging of our shares |  ✘ |

| We use targeted performance metrics to align pay with performance | ✔ | We do not reprice stock options and do not issue discounted stock options without shareholder approval |  ✘ |

We maintain stock ownership CEO; 3x base salary for other | We do not provide excessive perquisites |  ✘ | |

| We have shareholder-approved incentive plans | We do not have multi-year guarantees for compensation increases |  ✘ | |

| We have a broad clawback policy | |||

| We have a double-trigger change in control policy | |||

NO ADJUSTMENTS TO COMPENSATION PROGRAMS FOR THE COVID-19 PANDEMIC | |||

PROXY SUMMARY

| During 2020 we did not make any changes or adjustments to our executive compensation program specifically in response to the COVID-19 pandemic. The Compensation and Executive Development Committee did not modify individual performance goals or the corporate performance goals that were established at the beginning of the fiscal year, prior to the onset of the COVID-19 pandemic, for the annual bonus (EMIP) or outstanding performance share awards. |

COMPENSATION FRAMEWORK & PHILOSOPHY

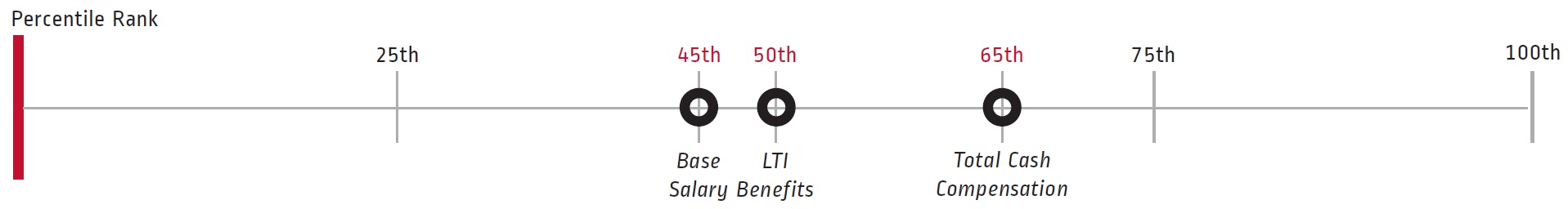

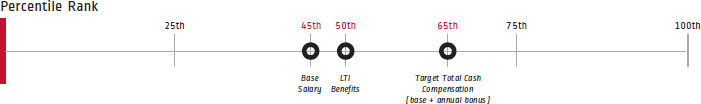

Our compensation program is designed to attract and retain exceptional employees. We also maintain a strong pay for performance culture. As indicated below, we design our compensation system to reflect current best practices, including setting base pay below the competitive market for each position, targeting incentive-based cash compensation above the competitive market and promoting quality corporate governance in compensation decisions. We believe these practices result in sustained, long-term shareholder value and reflect our philosophy that the pay for our best performers should receivealign with the greatest rewards.results of our long-term goals.

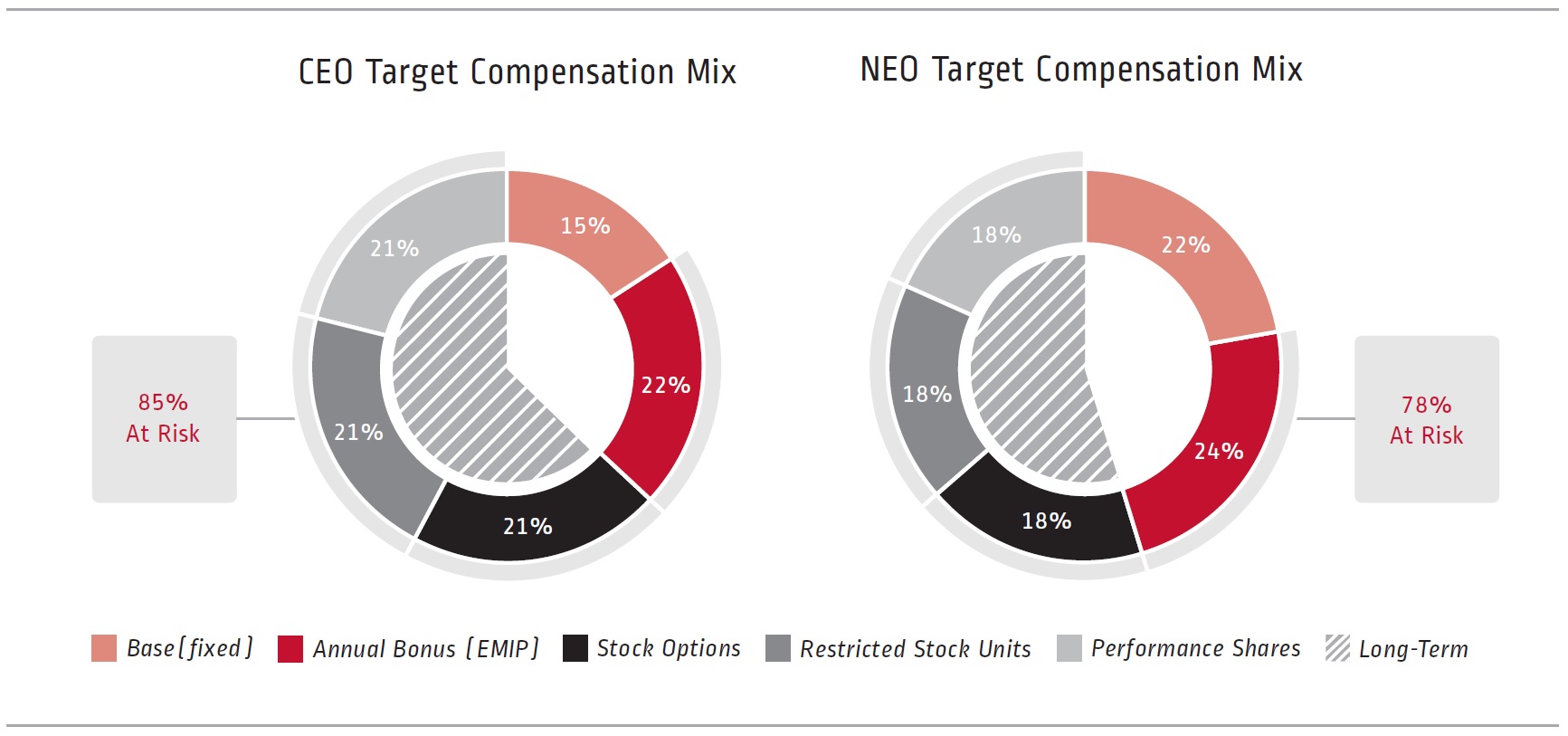

Our executive compensation program consists of three primary elements of total direct compensation: base salary (fixed), short-term incentive compensation (at-risk) in the form of an annual bonus (EMIP), and long-term incentive compensation (at-risk) in the form of stock options, RSUsrestricted stock units (RSUs) and performance shares.

· Base salary is · Short-term incentive compensation is based on annual consolidated and, if applicable, segment performance, and individual performance | · Long-term incentive compensation is based on our financial performance over a three-year cycle · Variable, “at risk,” pay is a significant percentage of total compensation |

| 15 |

| - |

|

| 16 |

| - |

|

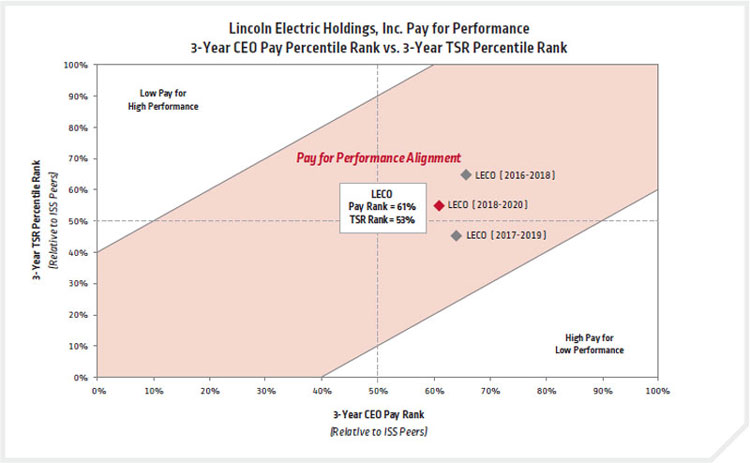

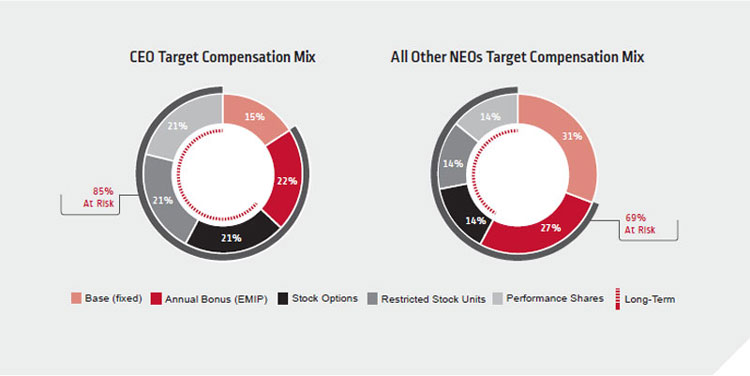

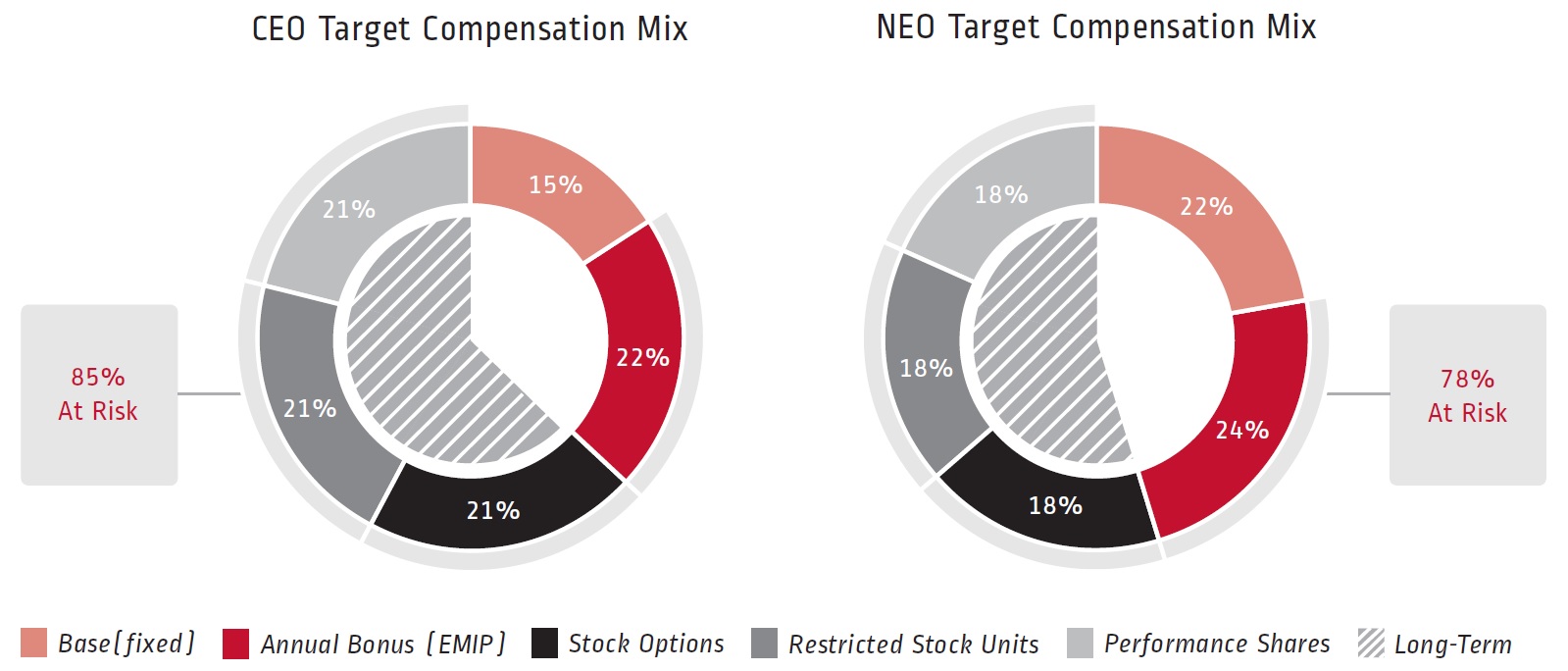

AVERAGE MIX OF KEY COMPENSATION COMPONENTS AND KEY COMPENSATION METRICS

The following charts present the mix of 20182020 target direct compensation for our Chief Executive Officer (CEO) and all NEOs.of our other NEOs, as established in the beginning of 2020. As shown below, 85% of our CEO’s compensation value and, on average, 78%69% of all of our other NEOs’ compensation value was “at risk,” with the actual amounts realized based on annual and long-term performance as well as our stock price.

We use the following six key financial performance measures to evaluate results acrossin our short-term and long-term periods.compensation programs.

Key Performance Metrics Tied to Executive Compensation

| Key Performance Metrics Tied to Executive Compensation | ||

Metric | Compensation (Annual Bonus) | Long-Term Incentive |

| EBITB1,2(Earnings before interest, taxes and bonus) | ||

| Average Operating Working Capital to Sales2ratio | ||

| Consolidated, segment and individual performance | ||

| Adjusted Net Income2growth | ||

| Return on Invested Capital (ROIC)2 | ||

| Total Shareholder Return (TSR)2 | ||

| Individual Performance Goals3 | ✔ | |

(1) EBITB is an internal measure which tracks our adjusted operating income.

(2) Performance measures used in the design of the executive compensation program are defined in Appendix A.

AUDITOR //

We ask our shareholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019. Below is summary information about fees paid to Ernst & Young LLP for services provided during fiscal years 2018 and 2017.

| 2018 | 2017 | |

| Audit Fees | $3,318,000 | $3,474,000 |

| Audit-Related Fees | 72,000 | 14,000 |

| Tax Fees | 436,000 | 235,000 |

| All Other Fees | 0 | 0 |

| Total Fees | $3,826,000 | $3,723,000 |

| (1) |

| EBITB is an internal measure that tracks our adjusted operating income. |

| (2) | |||

| Financial performance measures used in the design of the executive compensation program are defined in Appendix A. Average Operating Working Capital to Sales for Compensation Purposes, Adjusted Net Income for Compensation Purposes, and Return on Investment Capital for Compensation Purposes have discrete definitions relative to our executive compensation program. |

| (3) | Individual performance goals are set annually and a significant portion of our executive officers’ individual performance goals are tied to one or more aspect of our 2025 Strategy including sustainability and human capital matters. |

LINCOLN ELECTRIC HOLDINGS, INC.

TABLE OF CONTENTS

| 17 |

| - |

|

| 18 |

| - |

|

Cautionary Note on Forward-Looking Statements: This Proxy Statement contains forward-looking statements regarding Lincoln Electric’s strategy and current expectations within the applicable securities laws and regulations. These statements reflect management’s current expectations and involve a number of risks and uncertainties. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “forecast,” “guidance,” or words of similar meaning. Actual results may differ materially from such statements due to a variety of factors that could adversely affect the Company’s operating results. The factors include, but are not limited to: general economic, financial and market conditions; the effectiveness of operating initiatives; completion of planned divestitures; interest rates; disruptions, uncertainty or volatility in the credit markets that may limit our access to capital; currency exchange rates and devaluations; adverse outcome of pending or potential litigation; actual costs of the Company’s rationalization plans; possible acquisitions, including the Company’s ability to successfully integrate acquisitions; market risks and price fluctuations related to the purchase of commodities and energy; global regulatory complexity; the effects of changes in tax law; tariff rates in the countries where the Company conducts business; and the possible effects of events beyond our control, such as political unrest, acts of terror, natural disasters and pandemics, including the current coronavirus disease (“COVID-19”) outbreak, on the Company or its customers, suppliers and the economy in general. The Company has experienced the negative impacts of COVID-19 on its markets and operations; however, the ultimate duration and severity on the Company’s business remains unknown. Although the Company’s customers have re-opened and increased operating levels, such customers may be forced to close or limit operations should a resurgence of COVID-19 cases occur. Given this continued level of economic and operational uncertainty over the impacts of COVID-19, the ultimate financial impact cannot be reasonably estimated at this time. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020. These forward-looking statements speak only as of the date on which such statements were made, and we undertake no obligation to update these statements except as required by federal securities law.

PROPOSAL 1—ELECTION OF DIRECTORS

DIRECTOR NOMINEES

Our shareholders are being asked to elect twelve Directors to serve until the 2022 Annual Meeting or until their successors are duly elected and qualified. Unless otherwise directed, shares represented by proxy will be votedFORthe following nominees:

All of the Director nominees, other than Mr. Goris,Ms. Walker, who was elected to the Board on July 19, 2018,October 20, 2020, have been previously elected by our shareholders.

Each of the nominees has agreed to stand for election.re-election. The biographies of all of our Director nominees can be found later in this section.

If any of the nomineesDirector nominee is unable to stand for election, the Board may provide for a lesser number of nominees or designate a substitute. In the latter event, shares represented by proxies solicited by the Directors may be voted for the substitute. We have no reason to believe that any of the nominees will be unable to stand for election.

MAJORITY VOTING POLICY

The Director nominees receiving the greatest number of votes will be elected (plurality standard). However, our majority voting policy states that any Director who fails to receive a majority of the votes cast in an uncontested director election in his/her favor is required to submit his/her resignation to the Board. The Nominating and Corporate Governance Committee of the Board would then consider each resignation and determine whether to accept or reject it.it, with full Board approval of such decision. Abstentions and broker non-votes will have no effect on the election of a Director and are not counted under our majority voting policy. Holders of common stock do not have cumulative voting rights with respect to the election of a Director.

YOUR BOARD RECOMMENDS A VOTEFOR EACH DIRECTOR NOMINEE LISTED ABOVE

ANNUAL MEETING ATTENDANCE; NO SPECIAL ARRANGEMENTS

Directors are expected to attend each annual meeting. The Director nominees plan to attend this year’s virtual Annual Meeting. At the 20182020 Annual Meeting, all of our then-current Directors were in attendance.attended our virtual annual meeting.

None of the Director nominees has any special arrangement or understanding with any other person pursuant to which the Director nominee was or is to be selected as a Director or nominee. There are no family relationships, as defined by SECSecurities and Exchange Commission (SEC) rules, among any of our Directors or executive officers. SEC rules define the term “family relationship” to mean any relationship by blood, marriage or adoption, not more remote than first cousin.

| - | |

| |

PROPOSAL 1—ELECTION OF DIRECTORS

| 20 |

| - |

|

| ||||||||

Director since 2012 Lead Independent Director since 2018 COMMITTEES: Audit Finance AGE: 56 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | PATRICK P. GORIS Director since 2018 COMMITTEES: Audit Nominating and Corporate Governance AGE: 49 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | |||||

Experience Mr. Espeland is the former Executive Vice President and Chief Financial Officer of Eastman Chemical Company,

· Significant experience in the areas of strategy, mergers and acquisitions, taxation and enterprise risk management. · International auditing experience having served as an independent auditor at Arthur Andersen LLP, · The Board has determined that Mr. Espeland’s extensive accounting and · Valuable insight into advancing the business priorities of · Valuable knowledge of key governance matters gained as a | ||||||||

|

Mr. Goris has served as the Senior Vice President and Chief Financial Officer of Carrier Global Corporation, a leading global provider of healthy, safe and sustainable building and cold chain solutions, since November 2020. Prior to joining Carrier, he served as Senior Vice President and Chief Financial Officer of Rockwell Automation,

· Extensive experience in accounting, financial planning and analysis, investor relations and · Experience with a global industrial automation and information solutions company provides · The Board has determined that Mr. Goris’ extensive accounting and financial experience qualifies him as an | |||||||

DIRECTOR NOMINEES

| ||||||||

Director since 2006 COMMITTEES: Audit (Chair) Finance AGE: 70 OTHER PUBLIC COMPANY |  | MICHAEL F. HILTON Director since 2015 COMMITTEES: Compensation and Executive Development Nominating and Corporate Governance AGE: 66 OTHER PUBLIC COMPANY DIRECTORSHIPS: Ryder Systems, Inc. (NYSE: R) since 2012 Regal Beloit Corporation |  | |||||

Experience Mr.

Mr. Hanks also formerly served as Washington Group’s Executive Vice President, Chief Legal Officer and Secretary. In addition, Mr. Hanks has extensive board experience, previously serving as a director of McDermott International, Inc.

· Diverse professional skill set, including finance (having served as CFO of Morrison Knudsen) and legal and governance competencies (such as enterprise risk management, corporate compliance and legal strategy) · The Board · Valuable knowledge of key governance matters gained as a director of Lincoln Electric and several other publicly-traded companies. | ||||||||

|

Mr. Hilton is the former President and Chief Executive Officer of Nordson Corporation

·With over 30 years of global manufacturing experience, Mr. Hilton brings to the Board an intimate understanding of management · Extensive experience with strategy development and day-to-day operations of a multi-national company, including product line management, new product technology, talent development, manufacturing, distribution and other sales channels, business processes, international operations and global markets expertise. · Valuable knowledge of key governance matters gained as a several other publicly-traded companies. | |||||||

| 21 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

DIRECTOR NOMINEES

| 22 |

| - |

|

| ||||||||

COMMITTEES: Audit Finance AGE: 74 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | KATHRYN JO LINCOLN Director since 1995 COMMITTEES: Compensation and Executive Development Nominating and Corporate Governance (Chair) AGE: 66 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | |||||

Experience Mr. Lincoln has served as the president of N.A.S.T. Inc.

·As an entrepreneurial businessman with executive leadership and investment experience, including 25 years running a $50 million business, Mr. Lincoln understands business risk and the importance of · Experience as a board member of various organizations, including as a board member of the Cleveland Museum of Natural History. · As the grandson of James F. Lincoln and as a long-term trustee, Mr. Lincoln provides the Board with his historic perspective on the Company’s unique culture and · Valuable knowledge of key governance matters gained as a | ||||||||

|

Ms. Lincoln has served as the Board Chair and Chief Investment Officer of the Lincoln Institute of Land Policy,

She is also the Co-Chair of the International Center for Land Policy Studies and Training in Taiwan.

· As a Lincoln family member and long-standing Director of Lincoln Electric, Ms. Lincoln has a keen sense of knowledge about Lincoln Electric, its culture and the founding principles. | |||||||

DIRECTOR NOMINEES

| ||||||||

Director since 2007 COMMITTEES: Compensation and Executive Development (Chair) Finance AGE: 74 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | CHRISTOPHER L. MAPES Director since 2010 Chairman since 2013 COMMITTEES: None AGE: 59 OTHER PUBLIC COMPANY DIRECTORSHIPS: The Timken Company (NYSE: TKR) since 2014 |  | |||||

Experience Mr. MacDonald is the former Vice Chairman of National City Corporation,

· Experience addressing human resources and development challenges facing a · Valuable knowledge of key governance matters gained as a director of Lincoln Electric and several other publicly-traded companies. | ||||||||

|

Mr. Mapes is the Chairman, President and Chief Executive Officer of Lincoln Electric. Mr. Mapes has served as President and Chief Executive Officer since December

The Timken Company

· Keen understanding of the manufacturing industry and · In addition to · Valuable knowledge of key governance matters gained as a director of Lincoln Electric. | |||||||

| 23 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

DIRECTOR NOMINEES

| 24 |

| - |

|

| ||||||||

COMMITTEES: Compensation and Executive Development Finance (Chair) AGE: 70 OTHER PUBLIC COMPANY DIRECTORSHIPS: GCP Applied Technologies |  | BEN P. PATEL Director since 2018 COMMITTEES: Audit Nominating and Corporate Governance AGE: 53 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | |||||

Experience Mr. Mason is the former President of the Europe, Middle East & Africa Sector (EMEA Sector) of Ecolab, Inc.

In addition, Mr. Mason has public company board experience, previously serving as a director of GCP Applied Technologies

· Executive leadership experience in an international business unit for a U.S. publicly-traded company, providing Mr. Mason · Extensive international business experience, · Strong finance and strategic planning

· Valuable knowledge of key governance matters gained as a director of Lincoln Electric. | ||||||||

|

Mr. Patel has served as Senior Vice President, Chief Technology Officer of Cooper Tire & Rubber Company, a global manufacturer of specialized passenger car, light truck, medium truck, motorcycle and racing tires since November 2019. He previously served as Senior Vice President and Chief Technology Officer of Tenneco, Inc.

· Broad expertise in material science, automation and “smart” systems, as well as extensive research and development experience. · Mr. Patel has been a leader in global innovation and research · Valuable knowledge of | |||||||

DIRECTOR NOMINEES

| ||||||||

Director since 2001 COMMITTEES: Compensation and Executive Development Nominating and Corporate Governance AGE: 72 OTHER PUBLIC COMPANY |  | KELLYE L. WALKER Director since 2020 COMMITTEES: Compensation and Executive Development Nominating and Corporate Governance AGE: 54 OTHER PUBLIC COMPANY DIRECTORSHIPS: None |  | |||||

Experience Ms. Runtagh is the former President and Chief Executive Officer of the Berwind Group, at General Electric Company,

· Diverse management experience, including growing · Extensive experience as a director of publicly-traded companies. · Valuable knowledge of key governance matters gained as a director of Lincoln Electric and several other publicly-traded companies. | Experience Ms. Walker has served as the Executive Vice President and Chief Legal Officer of Eastman Chemical Company, an advanced materials and specialty additives manufacturer, since April 2020. In this role, Ms. Walker has overall leadership and responsibility for Eastman’s legal organization. She also served as Executive Vice President and Chief Legal Officer of Huntington Ingalls Industries, Inc., America’s largest military shipbuilder, from 2015 to 2020. Prior to joining Huntington Ingalls Industries, Inc., Ms. Walker served as Senior Vice President, General Counsel and Secretary at American Water Works Company, Inc. Reasons for Nomination · Seasoned senior executive with 25 years of experience with publicly-traded companies, helping to increase organizational value through forward thinking, strategic discipline and a focus on continuous improvement. · Extensive experience in corporate governance, compliance and litigation management, government affairs, strategy development, product stewardship and regulatory affairs, global business conduct and global health, safety, environment and security. · Long-standing general counsel of publicly-traded companies and has also served as Chief Administrative Officer, leading human resources, information technologies, government affairs and corporate communications functions. · Extensive leadership across various industries including global public companies, | |||||||

| 25 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

| 26 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

Governance FrameworkGOVERNANCE FRAMEWORK

At Lincoln Electric, weWe are committed to effective corporate governance and high ethical standards. We adhere to our ethical commitments in every aspect of our business, including our commitments to each other, in the marketplace and in the global, governmental and political arenas. These commitments are spelled out in our Code of Corporate Conduct and Ethics, which applies to all of our employees (including our principal executiveCEO and senior financial officers)our other NEOs) and Directors.

We encourage you to visit our website at www.lincolnelectric.com, where you can find detailed information about our corporate governance programs/policies including:

· Code of Corporate Conduct and Ethics · Governance Guidelines | · Charters for our Board Committees · Director Independence Standards |

| CORPORATE GOVERNANCE HIGHLIGHTS | ||||

· Our Board held · During · Size of · Plurality vote with director resignation policy for failures to receive a majority vote in uncontested director elections ·

· All Directors are expected to attend the Annual Meeting

· Number of independent · Diverse Board including · Several current and former CEOs · Global experience · Audit Committee has multiple financial experts

· Independent Directors meet without management present · Annual Board and Committee self-assessments · Board · Governance Guidelines approved by Board · Board · Full Board review of succession planning annually | BOARD ALIGNMENT WITH SHAREHOLDERS

· Annual equity grants align interests of Directors and officers with shareholders · Annual advisory approval of named executive officer compensation · No poison pill · Stock ownership

· No employment agreements · Executive compensation is tied to · Anti-hedging and anti-pledging policies for Directors and officers · Recoupment/clawback policy

· Code of Corporate Conduct and Ethics for employees, officers and Directors · Environmental, health and safety guidelines and goals, including long-term sustainability goals · Annual compliance training

· Enterprise risk management program with Board oversight |

SHAREHOLDER ENGAGEMENT

We are committed to engaging in constructive conversations with shareholders and nurturing long-term relationships with the investment community. We maintain an active shareholder engagement program where executives and management from various departments meet with shareholders regularly to discuss a variety of topics including business performance, strategic initiatives, corporate governance practices, corporate sustainability initiatives, executive compensation, and other matters of shareholder interest. The Board values an active investor relations program as it believes that shareholder input strengthens its role as an informed and engaged fiduciary.

Our shareholder engagement program includes participation at investor conferences, holding meetings and tours at Lincoln Electric, visiting investors at their offices, hosting tradeshow tours, being accessible to shareholder inquiries throughout the year and communicating with transparency. In 2020, we maintained active engagement with the investment community despite COVID-19 restrictions with calls/videoconferencing, a virtual annual shareholder meeting, virtual investor conferences and non-deal roadshows, as well as a virtual Lincoln Electric product exposition. Our efforts were recognized by Institutional Investors’ “All-American Executive Team” 2020 rankings, where our CEO, CFO and Investor Relations were among the top-3 midcap machinery executives in their respective areas. In addition, we reached out to investors representing approximately 49 percent of our outstanding shares to discuss corporate governance and sustainability (ESG) matters. We continued to gain good insights on our practices and policies and received positive feedback on the execution of our strategy, corporate governance, executive compensation, environmental, health and safety practices, and our investor relations program.

CORPORATE SUSTAINABILITY MATTERS

The Board recognizes the importance of achieving our goals responsibly, and this alignment with our key stakeholders also drives long-term value creation.

Our approach to sustainability began 125 years ago by our founders who established the Company under the guiding principle of The Golden Rule: Treating others how you would like to be treated. Our culture, values and our commitment to diversity and inclusion reflect The Golden Rule and our Purpose of Operating by a Higher Standard to Build a Better World.

Our governance structure for sustainability includes Board oversight, primarily driven by the Audit Committee, and sustainability metrics are incorporated into the annual goals of Directorsour CEO and our other executives. Our Executive Vice President and General Counsel oversees corporate environmental, health and safety (EH&S) initiatives and global reporting, and works closely with business unit leadership and local facilities to implement, monitor and measure our results. During 2020, we established an internal sustainability counsel with a primary focus on enhancing product stewardship for sustainable solutions.

The following policies and business practices exemplify our commitment to ESG matters:

· Our guiding principle is The Golden Rule; · Our Code of Corporate Conduct and Ethics; · Our Supplier Code of Conduct; · Health, safety and wellness initiatives for our employees, customers and communities; · Our Human Rights Policy; · Equal employment opportunities, along with our pledge to treat employees fairly, with dignity, and without discrimination in any form; · Focus on improving environmental performance, including long-term safety and environmental goals and performance reporting, and an emphasis on product stewardship; · Training and development programs to attract and retain high performing employees and help them reach their full potential; | · Community engagement through employee-led fundraisers, grants provided by The Lincoln Electric Foundation, scholarships, in-kind gifts, and an employee matching and “Dollars for Doers” program to support volunteerism; · Positively impacting manufacturing and industry by promoting the art and science of welding among students and young professionals through our business initiatives, partnerships with schools and associations, and programming at the J.F. Lincoln Foundation; and · Enhancing diversity and inclusion through employee resource groups including our Diversity Councils, Veterans, Women in Lincoln Leadership, and Young Professionals organization. | |

| 27 |

| - |

|

| 28 |

| - |

|

OUR BOARD OF DIRECTORS

Our Board oversees management in the long-term interest of Lincoln Electric and our shareholders.stakeholders. The Board’s major responsibilities include:

· Overseeing the conduct of our business · Reviewing and approving key financial objectives, strategic and operating plans and other significant actions · Evaluating CEO and senior management performance and determining executive compensation | · Planning for CEO succession and monitoring management’s succession planning for other key executives | · Establishing an appropriate governance structure, including appropriate Board composition and succession planning · Overseeing enterprise risk management · Overseeing the ethics and compliance program · Overseeing ESG and diversity and inclusion matters |

How We Select Director NomineesHOW WE SELECT DIRECTOR NOMINEES

In evaluating Director candidates, including persons nominated by shareholders, the Nominating and Corporate Governance Committee expects that any candidate must have these minimum qualifications:

· · High-level managerial experience or experience dealing with complex · Ability to work effectively with others · Sufficient time to devote to the affairs of Lincoln Electric | · Specialized experience and background that will add to the depth and breadth of the Board · Independence as defined by the Nasdaq listing standards (for non-employee Directors) · Financial literacy |

In evaluating candidates to recommend to the

BOARD DIVERSITY

To maintain Board including the Director nominees,diversity, the Nominating and Corporate Governance Committee is committed to include in each director candidate search individuals that represent diversity of race and gender. The Nominating and Corporate Governance committee also considers whether the candidate enhances the diversity of the Board. Such diversity includesnational origin, professional background and capabilities, knowledge of specific industries, and geographic experience. Throughout 2020, the Nominating and Corporate Governance Committee reviewed the skills, qualifications and experience as well as race, gender and national origin.of each Director nominee to ensure that each can effectively oversee our long-term business strategy.

Lincoln Electric isWe are also committed to having Director candidates that can provide perspective on the industry challenges that we face and our long-term commitment to a pay for performance culture.

During 2018, two new directors were elected to the Board in light of two retirements from the Board. In February 2018, Mr. Ben Patel was elected to the Board and, in July 2018, Mr. Patrick Goris was elected to the Board. In recruiting Messrs. Patel and Goris, the The Nominating and Corporate Governance Committee retainedCommittee’s process for identifying and evaluating nominees for Director includes annually discussing prospective Director specifications, which serve as the baseline to evaluate candidates. When recruiting new Director candidates, we may involve a recognized search firm, to help identify director prospects, perform candidate outreach, assist in reference and background checks and provide other related services. In recruiting Mr. Patel, the Korn Ferry search firm was retained and in recruiting Mr. Goris, the Heidrick & Struggles search firm was retained. The recruiting process typically involves, and for these searches did involve, the search firm, the CEO and/or a member of the Nominating and Corporate Governance Committee (usually, the Chair) contactingwill contact the prospective director to gauge his or her interest and availability. The candidate will then meet with several members of the Board, including our Lead Independent Director. At the same time, the search firm will contact references for the prospect.prospect will be contacted. A background check is generally completed before a final recommendation is made to the Board to appoint a candidate to the Board.

In identifying Mr. Patel, the Board targeted senior executives who had experience in managing global businesses where the ability to drive collaborative technologies to various markets and global customers is a critical portion of the strategy. Experience in leadership and management of technologies, whether through exposure to automation capabilities, “internet of things” (IoT), internet-based marketing or data analytics, was a key focus for the search. Mr. Patel’s technology-based experience at a global, publicly-traded company was determined to be a good fit for the Board and heOctober 2020, Ms. Kellye Walker was elected to the Board on February 21, 2018.

Board. In identifying Mr. Goris,recruiting Ms. Walker, the Board targeted senior executives who hadNominating and Corporate Governance Committee considered her background and skills and determined that her extensive leadership experience across various industries in managing the finance functionlegal, corporate governance and strategy development would be integral in a large, global business. As the Chief Financial Officer of a publicly-traded company and with his extensive finance and accounting experience, Mr. Goris is considered an “audit committee financial expert.” In addition,

Mr. Goris’ position as a senior executive at a global industrial automation and information solutions company provides him with broad exposure to digital operations and “smart” manufacturing solutions using data and analytics that enhance operational intelligence, productivity and risk management in manufacturing processes. These are key initiatives inhelping advance our long-term strategic objectives. Accordingly, Mr. Goris was elected to the Board on July 19, 2018.

2025 Strategy.

Shareholders may nominate one or more persons for election as Director of Lincoln Electric. The process for doing so is set forth in the FAQs section of this Proxy Statement.

PROPOSAL 1—ELECTION OF DIRECTORS Director candidates recommended by our shareholders will be considered by the Nominating and Corporate Governance Committee in accordance with the criteria outlined above.

Director IndependenceDIRECTOR INDEPENDENCE

Each of our non-employee Directors meets the independence standards set forth in the Nasdaq listing standards, which are reflected in our Director Independence Standards. To be considered independent, the Nominating and Corporate Governance Committee must affirmatively determine that the director has no material relationship with Lincoln Electric. In addition to outlining the independence standards set forth in the NASDAQ listing standards, the Director Independence Standards outline specific relationships that are deemed to be categorically immaterial for purposes of director independence. The Director Independence Standards are available on our website at www.lincolnelectric.com.

During 2018,2020, the independent Directors met in regularly scheduled Executive Sessions in conjunction with each of the Board meetings. The Lead Independent Director presided over these sessions.

Board LeadershipBOARD LEADERSHIP

Our Chairman,Mr. Mapes, our President and CEO, serves as Chairman of the Board, in addition to his other responsibilities. As Chairman, he is responsible for planning, formulating and coordinating the development and execution of our corporate strategy, policies, goals and objectives. He is accountable for Lincoln Electric’s performance and:

· reports directly to our · works closely with our management to develop our strategic plan; · works with our management on transactional matters by networking with strategic relationships; · promotes and monitors the Board’s fulfillment of its oversight and governance responsibilities; · encourages the Board to set and implement our goals and strategies; | · establishes procedures to govern our Board’s work; · oversees the execution of the financial and other decisions of our Board; · makes available to all members of our Board opportunities to acquire sufficient knowledge and understanding of our business to enable them to make informed judgments; · presides over meetings of our shareholders; and · sets the agenda for, and presides over, Board meetings. |

Mr. Mapes, our President and CEO, serves as Chairman in addition to his other responsibilities.

Our Board believes having one individual serve as Chairman and CEO is beneficial to us because the dual role enhances Mr. Mapes’ ability to provide direction and insight on strategic initiatives impacting us and our shareholders. The Board also believes the dual role is consistent with good corporate governance practices because it is complemented by a Lead Independent Director.

Lead Director

Our Lead Director is appointed each year by the independent Directors and serves as a liaison between the Chairman of the Board and the independent Directors. The Lead Director collaborates with the Chairman, the Secretary and senior management on the format and adequacy of the information that Directors receive and on the effectiveness of the Board meeting process. The Lead Director acts independently of the Chairman to review and approve Board meeting agendas and schedules. The Lead Director also acts as a sounding board to the Chairman of the Board on key aspects of the business, and assists in promoting sound corporate governance practices. In addition, the Lead Director may call meetings of the independent Directors as he or she sees fit and presides over such meetings. During 2018, the independent Directors met in conjunction with each of the Board meetings. The Lead Director may also speak

LEAD INDEPENDENT DIRECTOR Our Lead Independent Director focuses on overseeing the Board’s processes and prioritizing the right areas of focus. Our Lead Independent Director is appointed each year by the independent Directors and serves as a liaison between the Chairman of the Board and the independent Directors. Specifically, the Lead Independent Director has the following duties, responsibilities, and expectations: · Collaborates with the Chairman, the Secretary and senior management on the format and adequacy of the information that Directors receive and on the effectiveness of the Board meeting process. · Acts independently of the Chairman to review and approve Board meeting agendas and schedules. · Acts as a sounding board to the Chairman of the Board on key aspects of the business, and assists in promoting sound corporate governance practices. |

Mr. Curtis Espeland currently serves as our Lead Independent Director, a position he has held since 2018. Mr. Espeland was elected to our Board in February 2012. During his tenure on our strong working relationships with his fellow directors, and assisted with the onboarding of our three most recently elected directors. | |

· Calls meetings of the independent Directors as he sees fit, presiding over such meetings. · Speaks on behalf of Lincoln Electric, as the Board determines necessary. |

Mr. Curtis Espeland currently serves as our Lead Director, a position he has held since the 2018 Annual Meeting.

Board Role in Enterprise Risk ManagementBOARD ROLE IN ENTERPRISE RISK MANAGEMENT

In the ordinary course of business, we face various strategic, operating and compliance risks. Our enterprise risk management process seeks to identify and address risks to the organization. Our Board oversees the management of these risks on an enterprise-wide basis, and the Lead Independent Director promotes our Board’s engagement in this process. A fundamental part of the process is to understand the Company’s risks, and to provide oversight as to how management is addressing these risks. The full Board reviews with management its process for enterprise risk management. In addition, the Audit Committee is charged with overseeing the Company’s risk assessment and management process each year, including ensuring that management has instituted processes to identify critical risks and has developed plans to manage such risks.

The Company maintains a risk management review process where risk is assessed throughout our entire organization, and is reported to a corporate risk committee comprised of members of our various business units and control functions. Each year, the committee identifies critical risks to the organization and those that are determined to be “high priority”“high-priority” risks are reported to the executive management committee and the Audit Committee.Board. Thereafter, “high priority”“high-priority” risks are assigned, as appropriate, to various Board Committees, or to the Board as a whole, for further review, analysis and development of appropriate plans for management and mitigation. The Board also has broad oversight with respectInformation security is a high-priority risk, and the Audit Committee receives updates at each meeting relative to this risk and the Company maintains a related cyber risk insurance policy.

| 29 |

| - |

|

| 30 |

| - |

|

BOARD ROLE IN STRATEGY OVERSIGHT

One of the Board’s key responsibilities is overseeing the Company’s strategic planning process, including reviewing the steps taken to develop strategic plans and approving the final plans. In 2020, this included receiving periodic updates regarding the Company’s execution and performance during the initial year of the 2025 Strategy. Our Board regularly discusses the key priorities of our Company, taking into consideration global economic, consumer and other significant trends. The Company’s long-term strategic plan is reviewed regularly with the Board, along with its annual operating plan, capital structure and sustainability performance.

We regularly assess risks related to our compensation and benefit programs, including our executive compensation programs,program, and our Compensation and Executive Development Committee is actively involved in those assessments. In addition, Willis Towers Watson, a compensation consultant engaged by management, has provided a risk assessment of our executive compensation programsprogram in the past. Although we have a long history of pay for performance and incentive-based compensation, we believe our compensation programs contain many mitigating factors to ensure that our employees are not encouraged to take unnecessary risks.

As a result of all these efforts, we do not believe the risks arising from our executive compensation policies and practices are reasonably likely to have a material adverse effect on Lincoln Electric.

RELATED PARTYRELATED-PARTY TRANSACTIONS

AnyThe Board has adopted a policy regarding the review and approval of transactions between the Company and its subsidiaries and certain related party transactions concerning Lincoln Electric and any of its Directors, officers or other employees (or any of their immediate family members)parties that are required to be disclosed in proxy statements, which are referred to and approved by the Chief Compliance Officeras “related-party transactions.” Related parties include our Directors, Director nominees, executive officers, persons controlling 5% of our common shares, and the immediate family members of these individuals. Pursuant to the policy, the Audit Committee. Committee is responsible for reviewing and approving related-party transactions and will consider information it deems appropriate, including, but not limited to, whether the terms of the transaction are no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the approximate dollar value of the transaction, and the nature and extent of the related party’s interest in the transaction. No Director will participate in any discussion or approval of a related-party transaction for which he or she is a related party, other than to provide material information concerning the transaction.

We define “related party“related-party transactions” generally as transactions collectively over $120,000 in any calendar year, in which any related party had, has or will have a direct or indirect material interest. We have a monitoring and reporting program, which includes requirements to report all actual or potential related party transactions during the self-interest of the employee, officer or Director may be at odds or conflict with the interests of Lincoln Electric, such as doing businessyear and information regarding all relationships with entities that are or may be controlled or significantly influenced by such persons or their immediate family members. Ourinvolving a related party transaction policies can be found in our Code of Corporate Conduct and Ethics, as well as the Audit Committee Charter, both of which are available on our website at www.lincolnelectric.com in the Investor Relations section.

party.

In February 2019,2020, the Audit Committee considered and approved a related partythe on-going related-party transaction involving P&R Specialty, Inc., a supplier to Lincoln Electric. Greg D. Blankenship, the brother of George D. Blankenship, our former Executive Vice President, President, Americas Welding, is the sole stockholder and President of P&R Specialty, Inc. During 2018,2020, we purchased approximately $2.5$2.0 million worth of products from P&R Specialty in ordinary course of business transactions. George D. Blankenship has no ownership interest in or any involvement with P&R Specialty. We believe that the transactions with P&R Specialty were, and are, on terms no less favorable to us than those that could have been obtained from unaffiliated parties.

We have separately designated standing Audit, Compensation and Executive Development, and Nominating and Corporate Governance Committees established in accordance with applicable provisions of the Securities Exchange Act of 1934 (the “Exchange Act”) and Securities and Exchange Commission (“SEC”)SEC and Nasdaq rules. The Board also has designated a standing Finance Committee. The number of meetings held by each committee during 2018 is set forth below.

| Audit | Compensation & Executive Development | Nominating & Corporate Governance | Finance | |

| Number of Committee Meetings | 6 | 6 | 5 | 5 |

PROPOSAL 1—ELECTION OF DIRECTORS

Each committee has a charter, which details all of the committee’s roles and responsibilities. The following summaries set forth the principal responsibilities of each of the Board’s separately designated standing committees,committee, as well as other information regarding their makeup and operations. A copy of each committee’s charter may be found on our website at www.lincolnelectric.com.

| ||||||||

| Audit Committee | Compensation and Executive Development Committee | |||||||

Chair: Stephen G. Hanks | Members: Curtis E. Espeland Patrick P. Goris G. Russell Lincoln Ben P. Patel | Chair: William E. MacDonald, III | Members: Michael F. Hilton Kathryn Jo Lincoln Phillip J. Mason Hellene S. Runtagh | |||||

| Meetings held in 2020: 6 | ||||||||

| Meetings held in 2020: 7 | ||||||||

Key Responsibilities · ·

| ·Reviews ·Oversees enterprise risk management, risk assessment, ethics and compliance ·Reviews ·Reviews

| |||||||

Each | ||||||||

| ||||||||

Key Responsibilities ·Reviews and recommends to the Board total compensation of our CEO, and reviews and establishes total compensation of our other executive officers · ·Monitors ·Reviews and recommends to the Board, in conjunction with the Nominating and Corporate Governance Committee, the appointment and removal of |

·Oversees executive compensation policies, practices and programs, as further described in the CD&A ·Reviews and recommends to the Board new or amended executive compensation plans with our executive officers ·Oversees diversity and inclusion programming | |||||||

Each | ||||||||

| 31 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

| 32 |

| - |

|

Nominating and Corporate Governance | Finance Committee | |||||||

Chair: Kathryn Jo Lincoln

|

Ben P. Patel Hellene S. Runtagh | Chair: Phillip J. Mason | Members: Curtis E. Espeland Stephen G. Hanks G. Russell Lincoln William E. MacDonald, III | |||||

Meetings held in 2020: 5 | ||||||||

| ||||||||

Key Responsibilities ·Reviews · Reviews appropriate composition of the · Reviews shareholder proposals and shareholder engagement activities · Reviews non-employee Director compensation program in light of ·Reviews and · · | ||||||||

Each | ||||||||

| ||||||||

Key Responsibilities ·Reviews financial performance, including comparing ·Reviews capital ·Reviews | ·Reviews ·Reviews M&A activity and integration performance · Oversees strategic planning and financial policy matters

| |||||||

| Each | ||||||||

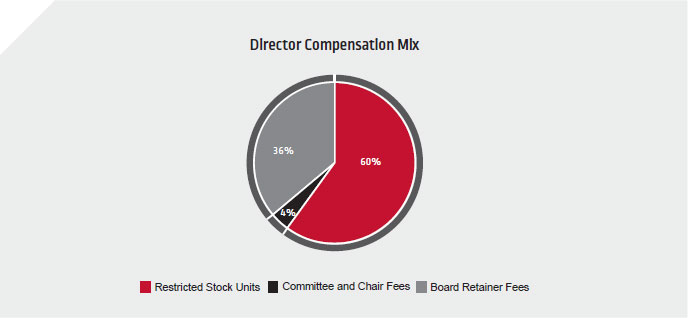

OUR BOARD COMPENSATION PROGRAM

Based upon the recommendations of the Nominating and Corporate Governance Committee, the Board determines our non-employee Director compensation. The Nominating and Corporate Governance Committee periodically reviews the statusall elements of Board compensation in relation to other comparable companies,our proxy peer group (as identified in the CD&A), trends in Board compensation and other factors it deems appropriate. In connection with its review in 2018,consultation with Korn Ferry as an independent advisor, the Nominating and Corporate Governance Committee made certaindid not recommend any adjustments to Board compensation to better align with our peer group. As a result of that review, in October 2018, the Board approved granting equity in the form of restricted stock units (RSUs) instead of restricted shares, and approved amending the Non-Employee Directors’ Deferred Compensation Plan to allow for the deferral of RSUs, in addition to cash compensation. during 2020.

The objectives of our non-employee Director compensation programsprogram are to attract highly qualified and diverse individuals to serve on our Board and to align their interests with those of our shareholders. An employee of Lincoln Electric who also serves as a Director does not receive any additional compensation for serving as a Director.

All non-employee Directors receive cash retainers and an annual stock-based award for serving on our Board. Stock-based compensation is provided under our 2015 Stock Plan for Non-Employee Directors. Below is a summary

GOOD GOVERNANCE PRACTICES

Lincoln Electric seeks to attract and retain highly qualified individuals to serve on the Board of Directors. To that end, Lincoln Electric maintains the philosophy of paying non-employee Directors fairly and reasonably, considering external market factors, consistent with good governance practices. With respect to our non-employee Director compensation program:program, our governance practices include:

| What We Do | |||||

✔ | No Hedging or Pledging of Lincoln Electric Stock | ✘ | |||

| Total compensation is positioned at the peer median | No Excessive Perquisites | ✘ | |||

| Non-employee Director compensation approved by full Board | ✔ | No Excise Tax Gross-Ups or Tax Reimbursements | ✘ | ||

| Full-value equity award granted at a fixed-value | ✔ | ||||

| Double Trigger Provisions for Change in Control | ✔ | ||||

Stock Ownership Guidelines | ✔ | ||||

Independent Advisor | ✔ | ||||

| ||||

(1) We do not have separate meeting fees, except if there are more than eight full Board or Committee meetings in any given year, Directors will receive $1,500 for each full Board meeting in excess of eight meetings and Committee members will receive $1,000 for each Committee meeting in excess of eight meetings in total.

(2) Directors have the ability to defer restricted stock units under the Non-Employee Directors’ Deferred Compensation Plan. Prior to October 2018, the annual stock-based award was in the form of restricted stock.

(3) The initial award will be pro-rated based on the Director’s length of service during the twelve-month period preceding the next regularly scheduled annual equity grant, which normally occurs in the fourth quarter of each year. Prior to October 2018, the initial stock-based award was in the form of restricted stock.

| 34 |

| - |

|

PROPOSAL 1—ELECTION OF DIRECTORS

The following is a summary of our current Director compensation program:

| Director Compensation Table | ||||||||||

| Director | Fees Earned or Paid in Cash | Stock Awards1 | All Other Compensation | Total | ||||||

| Curtis E. Espeland2 | $115,514 | 4 | $124,948 | — | $240,462 | |||||

| Patrick P. Goris3 | 36,087 | 4 | 175,270 | — | 211,357 | |||||

| David H. Gunning3 | 31,731 | — | — | 31,731 | ||||||

| Stephen G. Hanks2 | 92,000 | 124,948 | — | 216,948 | ||||||

| Michael Hilton | 80,000 | 124,948 | — | 204,948 | ||||||

| G. Russell Lincoln | 80,000 | 124,948 | — | 204,948 | ||||||